The Zenith Bank SWIFTPay solution offers our corporate customers a platform to initiate payment instructions from their ERP. The payment instruction is transmitted to Zenith Bank via the SWIFT network.

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunications. It is a messaging network that financial institutions use to securely transmit information and instructions through a standardized system of codes either between themselves or between them and their corporate customers who are registered on SWIFT.

Zenith Bank has been a member of SWIFT network since June 1998.

SCORE(Standardized Corporate Environment) enables corporates to use SWIFT's single, secure, and reliable messaging platform to access the SWIFT services that their financial institutions supports (e.g. FIN service, FileAct service etc.). SCORE is based on a Closed User Group that caters for financial messaging between corporates and financial institutions. Once registered to use Standardized Corporate Environment, a financial institution can interact with any corporate that is also registered in the Closed User Group. Conversely, a corporate registered in the Closed User Group can interact with any financial institution that is a member of Standardized Corporate Environment. Some key benefits include:

The Zenith Bank SWIFTPay solution offers our corporate customers a platform to initiate payment instructions from their ERP. The payment instruction is transmitted to Zenith Bank via the SWIFT network. SWIFT guarantees the security of the messages within its network and ensures it’s delivered safely to Zenith Bank for payments execution.

The following are two of the SWIFTNet Services that are supported by Zenith bank for corporates who want to make payments to its beneficiaries via the SWIFT network: FIN and FileAct Services.

FIN enables financial institutions to exchange individual structured (MT and ISO 15022 message formats) financial messages securely and reliably. Zenith Bank SWIFTPay solution currently supports the MT101 message format. MT101 is a SWIFT message format used for making payments via the SWIFT FIN service. MT101 SWIFT payments are also known as international wire transfers or telegraphic transfers. The FIN service is particularly suitable for corporate customers who will be making single payments to beneficiaries usually in small file sizes.

The following are the requirements and features of the SWIFT FIN service option for payments:

FileAct enables financial institutions to exchange bulk payment files securely and reliably. This consist of two files: the PayLoad file (Pain001- Customer Credit Transfer Initiation) and the Response File (Pain002 – Customer Payment Status Report). Zenith bank supports the ISO 20022 XML message format for these files.

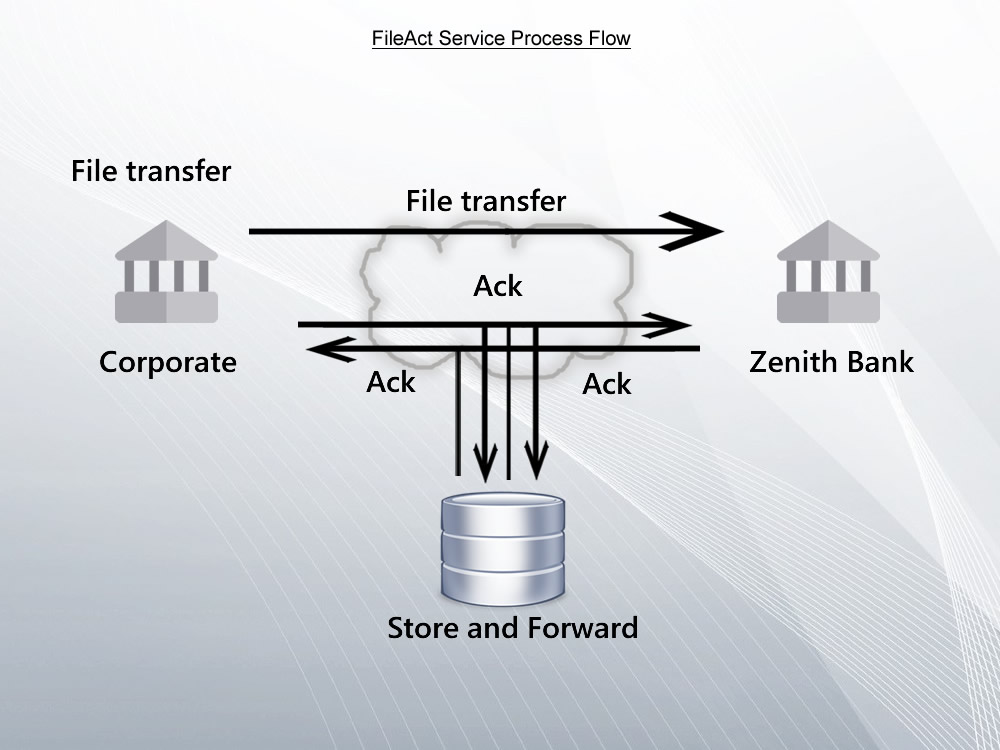

FileAct is particularly suitable for corporate customers who will be making bulk payments to several beneficiaries. When you need a secure, reliable and efficient way to transfer large files of data, FileAct is the solution. FileAct is a SWIFT service for transferring large files of structured messages. It’s also the messaging service to choose for large-scale reporting tasks. Files of almost any format or size may be sent, up to hundreds of MB. FileAct provides the security and reliability your business demands, including the highest availability in the industry. FileAct also offers non-repudiation; on request, SWIFT will re-verify a file signature to prove its origin. The diagram below illustrates the transfer of the Payload pain001 file (File Transfer) from the corporate customer to Zenith Bank and the response Pain002 file (ACK) from Zenith bank to the corporate customer.

The following are the requirements and features for using the SWIFT FIN service option for payments:

Email: zenithdirect@zenithbank.com

Telephone +234 1 278 7000

Telephone +234 1 292 7000

We are available to help you with any of your banking needs. Do you have a question? We have got answers to some frequently asked questions about our products and services and much more.